Bond Brand Loyalty Engages CRGroup For Data Centralization

Bond Brand Loyalty integrates data from disparate sources in a data warehouse and uses Microsoft Power BI to increase pipeline and project delivery efficiency and effectiveness.

Overview

Bond Brand Loyalty, a marketing agency, wanted an Integrated Decision-Making Platform (IDMP) to get continuous insights across its entire client project journey, from bidding to project delivery, to billing. Due to tremendous demand on its own resources, Bond asked CRGroup to assist in this journey. The new platform designed, developed and implemented by CRGroup now provides Bond with a 360° view of its business. The solution includes an automated SQL data warehouse and Power BI to unify different business systems used for operational, financial, and project management.

Using SQL Server for data management and Power BI for strategic analysis, Bond can now drive actions through insights, increase the speed and quality of client projects, save costs and improve margins.

The Organization

Bond is an integrated marketing services agency that provides solutions in customer experience design, brand loyalty consulting and management, CRM and digital marketing, channel and employee engagement. Bond has been recognized by Forrester, Gartner and Loyalty 360 as a market leader in Professional Services.

Situation

Serving clients that represent some of the world’s most influential and valuable brands, Bond was experiencing rapid business growth. Its nearly 500 employees dispersed across offices in Toronto, Detroit, New York, Atlanta, and Denver, had grown more dependent on each other to deliver increasingly complex solutions to its customers. However, their reliance on ad hoc communications and anecdotal decisions risked their ability to deliver.

Bond’s internal Data and Analytics Team had to work across three different business systems to support client solutions: Oracle NetSuite for CRM and financial management; Compass for preparing proposals and quotes; and Easy Projects software for project management. Compiling data manually across decentralized sources created costly inefficiencies and delays. Brian Kim, CFO of Bond Loyalty Group, said:

“Not having access to the right data and metrics on a timely basis, to measure the success of each project and report on its progress, was a significant hindrance to our ability to scale our rapidly growing business.” Brian Kim, CFO – Bond Brand Loyalty

The Search for a Better Solution

Overseeing Bond’s financial, legal, and administrative functions, Kim is responsible for developing the people, the processes and the tools required to facilitate growth, while increasing margins and project delivery. For Kim, pressure on these three areas of the organization adversely affected project delivery.

- People – The organization was unable to implement a data-driven performance management program for project team employees

- Processes – Inefficient business processes were established to compensate for siloed systems

- Systems – Inability to combine data from different systems into a single truth resulted in untimely, reactive, and error-prone decisions

It was imperative to centralize the data available from different systems to drive each of these areas’ strategic actions. In their annual planning session for Fiscal Year 2020, Bond executives agreed to adopt an Integrated Decision-Making Platform, as 1 of 8 Balanced Scorecard Objectives.

The Brief for an Integrated Decision-Making Platform

Given the pressures and resource constraints faced by its client-facing analytics team to help develop and implement a fully automated data platform, Kim contacted CRGroup. CRGroup had proven to be a reliable and strategic partner for Bond to help get its internal data systems in order. Having implemented solutions built on Power BI before, Bond trusted the technology to power its own solution.

Bond asked CRGroup to build a BI solution to address its users’ unique needs and business requirements:

- A centralized data warehouse with data flows from NetSuite™, Easy Projects™, and Compass™

- A 360° view of the business, serving the right data to the right people at the right time to enable timely and informative decisions

- A system that combines operational and financial metrics from each of the source systems to be able to track budgeted and actual resources and utilization, project milestones, and performance

- Authorized access to users, customized by audience and role, to improve customer onboarding, transitions, and resource management

- A BI tool with dashboards and interactive reporting capabilities that required minimal user training

A Consultative Process to Deliver a Winning Solution

After receiving the project brief, CRGroup consultants led by Dr. Vijay Jog, CRGroup’s founder, reviewed all existing process flows and documents for the business systems to be integrated. They conducted interviews and storyboarding sessions with key stakeholders to capture all the criteria required for different use cases and challenge the status quo. They ensured that the architected solution would provide quantifiable ROI.

The teams collaborated on weekly status meetings to review prototypes, subsequent design refinements, and progress. CRGroup made recommendations to simplify functionality and to reduce potential complexity in the final solution to control costs.

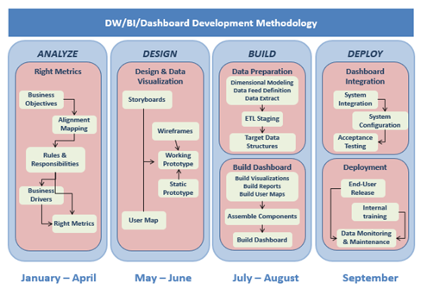

Methodology & Implementation

CRGroup clearly defined each phase of the engagement with specific deliverables. The final implementation was completed on budget and on time.

The Solution: A Power BI Solution that Delivers for Bond and for its Customers

The solution that CRGroup implemented for Bond connects data from multiple sources on the Azure cloud. Through Power BI, users can access and interact with data in real-time on a single dashboard. They can effortlessly create and share reports for insightful analysis and strategic actions, all within a secure system.

The Results

Using centralized data, Power BI provides an integrated view of a customer project’s entire life cycle, from bidding to completion. The Data and Analytics Team can quickly drill down on granular data, such as the number and dollar value of hours that are budgeted, spent, billed at the client, project, contract, and project manager level. Users can identify potential risk factors and respond quickly and decisively to mitigate against them. Brian Kim, the CFO, says:

“We are learning from data to bid better and to deliver better – to the satisfaction of our customers.”

Internally, managers can analyze projects along the Cost – Quality- cycle Time (CQT) dimensions to link incentives to project delivery team members’ performance.

Power BI is being integrated into all internal reporting across the organization. The solution empowers the executive team with proactive capacity planning for improved results. Executives can track key metrics, such as revenue and margin percentage per employee and service lines, based on fixed price vs fee-based projects.

The Benefits: Empowered Decisions for Strategic Outcomes

According to Kim, the Power BI solution overlay with well designed fully automated data warehouse drives remarkable ROI. Automated reporting reduced manual hours, proactive project management and issue resolution led to significant cost savings, and executive insights led to increased margins through resource prioritization and re-allocation.

Users are motivated by how the solution automates time- consuming manual processes and how it identifies clear actions. They can see how the solution helps them make effective decisions to save costs and increase productivity. For example, users can now forecast if a project is trending in the wrong direction and take mitigating actions before it is too late. Before Power BI, weeks or months would pass before a user noticed any risk to the project, with significant resources spent at irreversible cost.

Kim also noticed that collaboration among teams and departments have evolved into strategic conversations driven by insights, leading to decisive actions. Before Power BI, client teams relied on anecdotal discussions, lacking confidence in their ability to take required actions.

“The timeliness and reliability of the data powers us to be more agile as an organization and drive competitive advantage, both for ourselves and for our clients,” – Brian Kim, CFO, Bond Brand Loyalty

Ready to get started with Power BI?

Power BI connects to over 50 data sources your business already uses and pulls data into a centralized, easy-to-digest environment. Get started enabling your team and business today. Contact CRGroup to learn more. Contact us to discuss your business needs and explore our solutions today.

You might also like to explore…

Canadian Paralympic Committee Gains Real-Time Reporting & Decision Making with Dynamics 365 Business Central

“Business Central has transformed our accounting processes & has greatly enhanced our ability to make decisions that have a real impact on our organization and the many organizations & individuals that we support.”

Office Authority Simplifies Decision Making with Microsoft Power BI & CRG Company Combiner

“CRGroup helped us make data-driven decisions by deploying an end-to-end platform for real-time advanced analytics & BI, allowing us to have complete visibility across our different lines of business”